Cambridge Capital invests in companies with competent and honest managers and will consider investments in most sectors. To date Cambridge Capital has made investments in the healthcare sector and the consumer brands sector (“FMCG”) which includes investments in foods, apparel, personal care and home care products. Cambridge Capital prefers to acquire 60% to 100% of a company with management participation.

The company must be easy to understand and have a sustainable competitive advantage.

Cambridge Capital invests in market leading brands and companies that have high levels of intellectual property.

Annual profits between R10 – R200 million and a track record of over 7 years.

Cambridge Capital only invests in companies that have strong, honest management, and partners with this team.

As a business, we search for like-minded companies that are entrepreneurial in mindset and committed to the creation of long-term value. Companies that decide to join Cambridge Capital benefit from our deep sector expertise, access to funding, global reach and strategic insights.

We prefer to take a semi-active investor role in our investee companies by partnering with management teams to ensure continuity and alignment of long-term goals. In some cases, this is a very ‘hands-off’ relationship allowing management teams to run their businesses autonomously and in other cases it is a more structured approach, one that allows the company to benefit from our corporate framework and strategic oversight

We have two primary investment models

Group structure and access to new markets. Under our Platform model, we look to acquire and build platform companies that can add synergistic bolt-ons and further develop the companies in which it has invested.

Under this model we also look to partner with exceptional standalone business.

Selling one’s business is never an easy thing to do. Most of the business owners we deal with have spent the majority of lives, building their businesses brick by brick. Through hard work and perseverance, they’ve sharpened their skills in merchandising, purchasing, staff selection, etc. It’s a learning process and mistakes made in one year often contribute to competence and success in succeeding years.

As entrepreneurs ourselves, we fully understand and recognise the many years of blood sweat and tears it’s taken to get your business to where it is today and believe that we are the right partners to help take your business to new heights.

All of the businesses we own are run autonomously to an extraordinary degree. Our business owners are treated as respected partners and valued for their years of experience and insight.

72

Companies Acquired

3

Continents

R12,000,000,000

Capital Raised

R2,700,000,000

Profits Earned

Origin is a South Africa based growth-oriented, diversified group focused on transforming turnkey businesses in the retail, consumer products, industrial, and property sectors into market leaders. We drive innovation and operational excellence to maximise long-term value.

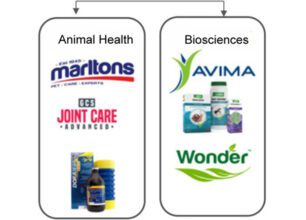

Founded in 2015 by the Cambridge Capital Group with earnings of approximately R400 million per annum, Marlin Brands is one of Australia’s leading portfolio of durable consumer brand companies focused on the living, gifting and convenience sectors